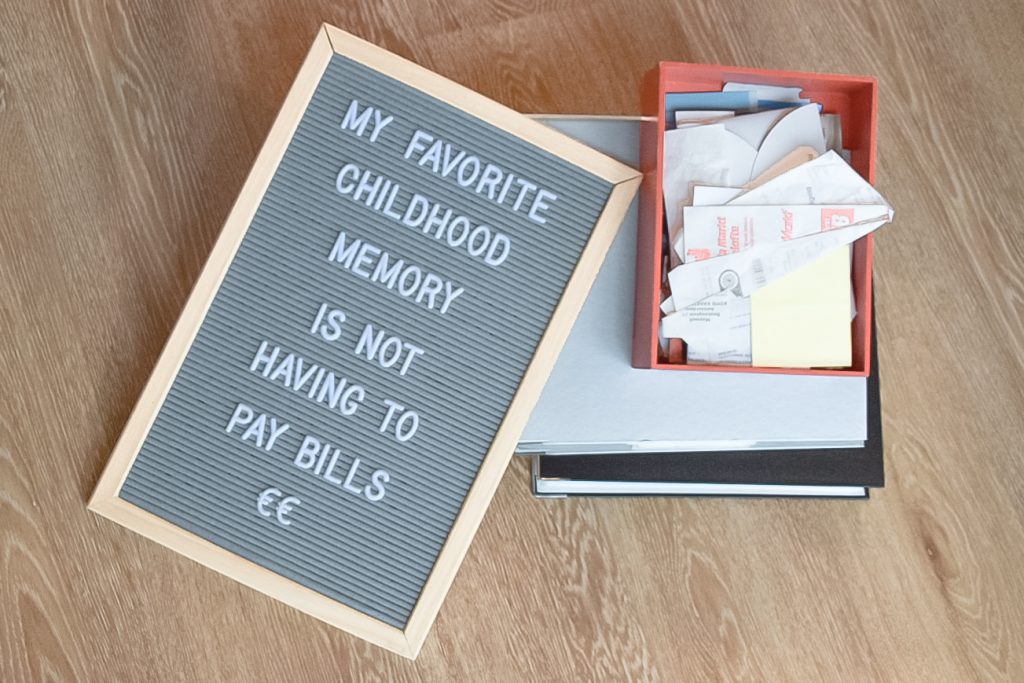

At times we all wish we have more to spend than we actually have. We have moments where we have big expenses: we bought a house, a car or started a family. Whatever your reason is, these are a couple of short term fixes for saving some extra cash.

Know what you make and what you spend

To actually know that you save more money then you spend is to know what you make and what your expenses are. Check your bank account and see what transactions where made over the last month or so. Make up a balance and see what your position is on your spending habits grouping them in categories. Go through them individually and see what expenses you can cut and what you can bring down.

Cut unnecessary expenses

Take a hard look at yourself (and your bank account) and decide if you really use that gym membership. You wanted to learn how to play the piano and got yourself an online membership. Have you been practicing? No? Cut it! That magazine that comes in every month and makes its way from the mail box straight into the recycle bin? Cancel it. Can you save on the energy bill by switching to a different provider? Do it! In the Netherlands you get the chance to switch health insurance providers once a year. Before the end of the year, see what you need and make the change to a health provider that still fits your needs and asks less of your hard earned money.

Pay off your debt

Having debt will cost you money, so if you are in a position to pay off your debt, it is wise to do so. Make minimal payments on all your debt and put larger amounts towards your smallest debt. As soon as you payed off the smallest debt, move on to the next one. This is called the debt snowball method by Dave Ramsey (he had to be mentioned in a post like this).

Save on utilities

There are some expenses you have to live with, like gas, water and electricity. Using them responsibly can save you a lot of money. Do you remember your mother yelling at you for showering too long? Or leaving the lights on? Well, she knew what all of that unnecessary use costs.

Electricity

Start by simply turn off the lights in a room you are not in. Swap the old light bulbs you have for LED light bulbs. They use way less energy. I have a hallway in my house that doesn’t have a window. There I use a Philips Hue LED light bulb with a movement sensor. It is a bit of an investment, but worth the money. I replaced the switch in the wall with a blind plate for the socket outlet. No more forgetting to turn off the lights. If you are in a position where you can afford solar panels and have the space to place them, it is something you might want to consider. It will save you money in the long run.

Water

Being smart with water usage will help you lowering your water bill. Don’t throw away old water from a coffee machine or water boiler, but give it to the plants. Take a 5 min shower in stead of one that takes 30 min. If you want to relax, don’t sit down underneath the shower, but fill up the tub. If you don’t have a bath tub, buy a hot water bottle and curl up underneath a cozy blanket. Don’t leave the water running while you brush your teeth and don’t wash the car or windows with a watering hose. Also don’t heat water for one cup of tea, but make a pot and keep it warm with a candle.

Heating

My house doesn’t have main gas, so I don’t have to worry about my gas bill and to be honest I don’t miss having gas. But I still need to be thoughtful about the heating. In the living room I have a smart thermostat by Tado. It turns off the heating when nobody is home and it gives me insight of what I’m spending on heating. Even if you do have main glass, think about how you use it. Close a window and put on a sweater before you turn op the heat.

Isolate your house

If you don’t have to pay for heating or air conditioning, you’ll end up saving money. Get better windows, isolate your walls, fix the hole in the roof. Finish the house and keep it in good condition. Close the doors to keep heat in. Do ventilate, but close the windows at night during the winter and during the day in summer.

Live on a budget

Whenever I was strapped for cash, I made myself live on a budget. I knew what I could and wanted to spend on groceries and what I wanted to save. So going to the super market turned into a game for me. Looking up deals, buying private labels in stead of the named-brand and trying to be out of the store as soon as possible. This made me try new things and have a more diverse diet. This also means buying less pre-cut and pre-washed greens. It made me look at the way I cooked and it turned out that having to cut my food myself made me better at handling a cooking knife. It also made me experiment with different dishes. Talking about added benefits!

Start eating healthy

As I mentioned before I changed my diet to save money. No more pricy candy bars but apples and no more potato chips but leafy greens. I did get some funny looks when I started eating raw spinach. Eating health also means that you only buy what you actually need. Prepacked food is usually more than you need and you’ll eat it anyway because it’s a waste to throw it out or you trow it out anyway. Next to that, there is a lot of food that is healthy and easy to store, like rice, pasta and nuts. Meat is pretty expensive (as it should be) and cutting down on eating it saves a lot of money. There are so many vegetarian and vegan options that after a while, you wouldn’t even mis it. But your wallet will feel the difference.

Quit smoking and other bad habits

Yes, this is the point where a non smoker tells you it will save you money if you quit smoking. I bet it is nothing new, same as it is something that is undeniably true and we all know it. If you are a smoker, all you have to do is see what it will save you if you didn’t smoke for a year and then consider if you think it is worth the try. I’ll stop there.

Buy in bulk

To know if it is really cheaper to buy in bulk, you’ll have to consider two things: will it expire before I use it? And is it really cheaper? Buying the larger packages are usually cheaper and for things like toilet paper you can’t really go wrong. Another thing you should buy in bulk is soap, whether it is for washing yourself, the dishes or to make laundry detergent with. It will save you a lot of money. Another thing is dried pasta, beans, rice and nuts. As I mentioned before, they are easy to store in pretty glass containers and it is relatively cheap food.

Automate savings

If you make it a regular habit to put some money in you savings account you’ll end up with more money without breaking a sweat. Every month, when your salary comes in, write an amount you can live without into this savings account. Let’s say you save 10€ each month, by the end of the year you’ll have an 120€ saved. Easy money. If you can make it 100€ a month, you’ll have 1.200€ extra saved. Easy does it.

Sell what you don’t use

We tend to gather stuff, but there is a lot amongst it that we just don’t use. You could throw it away, but you could just as easily try to sell some of it. You’ll be surprised how much you can make with selling stuff you don’t need. You’ll free up some closet space and you’ll have some extra money in the bank.

Swap stuff (books, games, clothes)

How many times do you read the same book or play the same video games over again? And that shirt that you hardly ever wear because you lost interest in it? Ask your friend if they have stuff they feel the same about. Not only will you end up with new second hand stuff, you also get rid of stuff you don’t use or need anymore. Consume less, share more!

Repair before you buy

A shopping addiction is a big reality for a lot of people and if you are out of money you really need to fight the urge to go online and satisfy the need to buy stuff. A good thing to do is to go through your closet and see what you still have. Do you have clothes you don’t wear because they are damaged? Repair them! It doesn’t take long to repair a stitch line or patch up a hole. And you can do the same with a lot of other things! If your chair is wobbly you can adjust some screws or place felt pad underneath the legs. There is so much you can do with string, glue, nails, oil and duct tape.

Walk or travel by bike when you can

You can take the car to every where you go, but why have a gym membership if you have the possibility to cycle to work and get that extra exercise? Two birds, one stone! And if there is commute you regularly take, see if there is a subscription plan that can save you some money, in stead of buying individual tickets.

Conclusion

There is still a lot to consider when making these changes, like time, environment and if it is worth the effort to put your energy into saving in stead of making more money. It doesn’t make sense to save and spend money on something you hardly ever use just because it is cheap. But having a good basis will help you be more conscious about your spending.